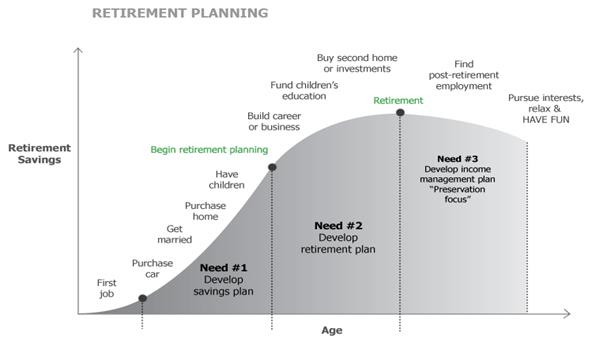

Retirement Planning

It's never too early or too late to start planning for retirement. This exciting life stage is a time when you can develop your interests, experience new things and explore different directions. The better prepared you are, the easier it will be.

Good planning can help you ensure that you are putting away enough for a retirement that is not just comfortable but will provide the lifestyle you aspire to.

When is the right time to make a plan?

If you're in your 50s or early 60s, your opportunity to secure your retirement plan will NEVER be as critical to get underway as right now.

If you are similar to many other people preparing for retirement, it can be very confusing trying to determine WHERE to invest your money safely to get the best returns:

📈 Do you buy shares...

🌐 Or contribute more super...

🏡 Or recycle some debt…

🖥 Or buy an investment property...

❓ Or do something else?

There are many options, some riskier than others, but not all are right for your specific circumstances.

To make matters worse, if you're like most people, you are well aware you need to do something NOW, but you’re probably too busy managing your career, paying down the mortgage and managing a busy family and personal life.

At the end of the day, you are too exhausted to worry or spend the time working on your financial future, so it falls into the “when I get around to it” basket.

If this sounds like you, what’s the solution?

The solution is - YOU NEED A PERSONAL RETIREMENT STRATEGY! Created with your circumstances and your needs in mind by someone who has the time, knowledge, experience and passion to do it!

We have been helping people prepare for retirement for 16 years, using our tried-and-tested strategies to assist clients in living their best retirement possible.

Rather than feeling CONFUSED, CONCERNED, and ILL PREPARED for retirement, imagine feeling “PREPARED, CONFIDENT & IN CONTROL” of your retirement plans well before retiring.

11% of baby boomers have not given much thought to retirement and have made no preparations, 24% have given some thought to it but made very little preparations and 44% have made some but not enough preparations.

Source: Mercer Wealth Solutions, Simple Super Research, May 2007

Timing Matters

If you are planning to retire in the next 10 years, you need several years to ensure you have time to make the required changes. We can help structure your financial situation, including assets and Income, to ( if eligible) maximise Centrelink benefits and /or ensure favourable tax outcomes especially if you're a business owner and are looking at selling your business to retire.

Remember, the time to plan is NOW before life gets in the way and you realise you’ve left it too late and have missed the opportunity to maximise your retirement outcomes!

To speak to our retirement specialist now, click here

Planning on retiring soon?

Like most Australians preparing for retirement, one of the greatest unknowns is how much they will spend once they stop working.

In 2020, NULIS ( Owner of Investment company MLC) commissioned its own research from actuarial firm Milliman, and found some surprising things we want to share with Australians planning for life after work, and the advisers who help them.

In 2020, Milliman reviewed the spending patterns, behaviour and trends of Australian retirees over the past 20 years, using innovative analytics to develop insights that will help our ageing population make meaningful plans for retirement with greater knowledge and confidence. The “It’s time for a new discussion The MLC 20:20 Retirement Report”, is the first paper in a series of four that focuses on lifestyle spending. Milliman has used extensive research expertise to drive insight into individual needs beyond the default averages most people are aware of.

So let’s get real about what matters in retirement, what it might look like and what it might cost. Download this report to get a better understanding of what to expect.

Applying for the Age Pension?

Most people who have dealt with Centrelink before understand some of the difficulties of dealing with such a large government institution. We can simplify this relationship for our clients.

The following report, compiled by National Seniors Australia in 2018, clearly outlines the scale and causes of the problems seniors experience in dealings with Centrelink. Further to this, an article in the financial review in 2024 highlighted that centerlink at six months behind on Age pension applications.

This is one of the reasons why we have a service called “Your Age Pension,” where we offer the client the opportunity never to have to deal with Centrelink again. For a small fee, deducted monthly from your bank account, we take care of all of your interactions with Centrelink.

Contact us below to find out more.

Downloadable Resources

National Seniors Age Pension Study "The Centrelink Experience"

Download Report