Key Investment Concepts

Understanding the key concepts that can help guide you in making the financial decisions that matter to you to achieve your goals.

There are numerous concepts that are crucial to understand when investing and building wealth. Understanding the concepts that drive investment markets and impact decision-making processes is critical to ensuring you stay on track and achieve your goals.

Many concepts impact investment decisions, so we have identified several of the most common and important ones to be aware of.

About Investing

What should you consider when investing?

There is a lot to think about before you invest. Generally, you won’t get the highest return at the level of risk you feel comfortable with. However, you need to consider how tolerant you are of market fluctuations and the probability that your investment returns may not meet your expectations and may even fall in value. When considering your investment strategy, ask yourself:

1) What are your financial goals?

Do you have a clear understanding of what it is you want to achieve? Are your goals financial? Or do they also involve lifestyle goals as well? Many people focus on just the financial goals but neglect the health and lifestyle goals that are required to be achieved so that you can enjoy your retirement.

2) How soon do you want to reach your goals?

The longer, the better, as it gives you the opportunity for the fantastic effects of compound interest to work in your favour. The longer you have to achieve your goals, the easier it will be. We refer to this as your investment, Horizon. This determines the length of time you have to accumulate your retirement nest egg and how long this money will be invested. It is important because time impacts how much you need to contribute and the return on the investment that you can expect.

3) How much do you have to invest?

For most people in Australia, the main investment vehicle is their Superannuation. You may say, what about my home? Well, as investment professionals, we do not consider the family home to be an investment asset.

Your employer is obliged to contribute 11% (and potentially up to 12% by 2025) of your ordinary time earnings to your Superannuation account, at least quarterly. This may not be enough to reach your retirement goals, and you may have to make additional contributions yourself through pay deductions, salary sacrifice, or by making additional after-tax payments up to allowable contribution limits.

If you are self-employed, you will need to fund your retirement without employer support. This is where other assets, such as investment properties and investing outside of super and growing other methods of income, become important.

One of the best ways to ascertain the level of contribution required to maintain your lifestyle during retirement is to seek the advice of a licensed financial adviser.

4) What level of income do you need in retirement?

This is the key to determining how much money you will need to accumulate to reach your retirement goals. For retirees, this determines how much money you will need in order to maintain your desired lifestyle during retirement.

5) What is your tolerance to risk?

How great a fall in the value of your investment funds could you cope with, and for how long? Are you willing to accept more risk, giving you the potential to earn greater returns but also the potential to incur greater losses? You should consider how you feel about fluctuations in the value of your investments and incurring capital losses, as well as capital gains.

6) How do we help you achieve these outcomes?

As a financial advisor, we help you develop an investment strategy with an asset allocation that is appropriate for your risk tolerance, goals and timeframe, backed up by years of experience and understanding of the risks involved, as well as an understanding of the common vices that may impact an investor and their behaviour.

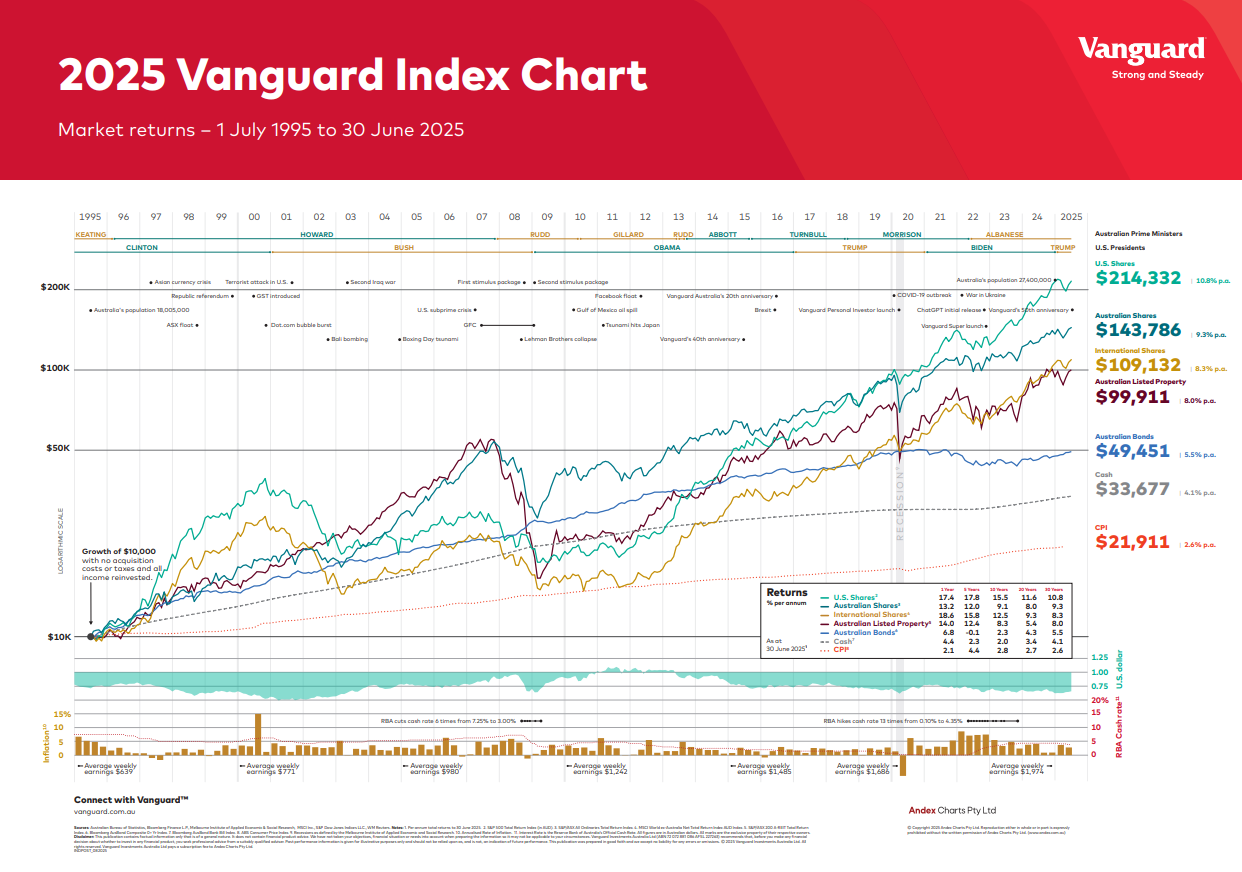

Investment Concept 1: The Financial Pyramid

Investment Concept 2: Risk & Return

To make informed financial decisions, you need to understand how you feel when your investment balances fluctuate and how this aligns with achieving your goals.

This is because it’s essential you are comfortable with investment movements; you will also need to make decisions as to what you are willing to trade off in relation to the level of risk you are comfortable with and when you would like to achieve your goals.

Risk and return tend to be closely related, so by choosing a lower level of risk, you are also choosing to reduce your long-term return expectations. You may be risk-averse and prefer to invest in safer, lower-interest cash in bank deposits where the value of your money is unlikely to fall.

You may accept the risk that the value of your money may go down over short periods of time, but it has the potential to earn a higher return over a longer timeframe if invested in growth assets such as shares and property.

It is important to remove the losses that are always possible, depending on the fluctuations in the share market and when you want to withdraw and use your investments.

A way of reducing risk is to diversify your investments. Before investing, it is important that you understand the concepts of risk, return, and diversification and how these may impact your personal situation.

What Do We Mean by Risk?

Risk, to some, may mean the possibility of losing a portion of your capital. For others, the risk that their assets will not generate sufficient income may be their primary concern. Risk cannot be eliminated. However, it can be measured and managed within an investment portfolio. The key is to determine the appropriate level of risk for you. Taking on greater short-term risks may be necessary to receive the long-term returns needed to achieve your lifestyle goals and objectives.

How Do You Cope with Risk?

It is important to understand the risks that you may be exposed to and how they will impact your personal situation. Assessing risk and potential investment returns should be in the context of your goals and the time that you have to achieve your objectives.

Investment Risk

All investments carry some level of risk. In an investment context, risk has traditionally been thought of as the possibility of losing some of the money you have invested. However, risk can also be considered as the chance that your retirement goals will not be met or that investments may not perform as expected.

Investments that offer the potential for higher long-term returns tend to exhibit greater fluctuations in returns in the short term. These investments are generally described as growth assets. Investments that provide more stable but possibly lower long-term returns are generally considered defensive assets. It is important to understand the type of investor you are and what you consider as acceptable in terms of risk.

Your risk profile will depend on your time frame, your level of acceptance of volatility in investment returns and your performance expectations. The following significant risks are identified to assist you in better understanding your investment decision.

Market Risk?

This refers to changes in investment valuations that may result in the loss of capital. Factors that drive changes in investment valuations include share market conditions, economic cycles, inflation, investor demand levels, business confidence and central bank policies.

Company-specific Risk

This refers to a company’s performance due to factors that are unique to that company. These factors may cause a share’s return to differ from that of the market and the risk that a share’s return is substantially below that of the market. Actively managed portfolios look to gain exposure to this risk to outperform the market.

Currency Risk

This refers to the fluctuations in the value of a foreign currency, which may impact the local value of overseas investments.

Manager Risk

This applies where an investment is via a managed fund and refers to the risk that the manager will neither achieve its performance objectives nor produce returns that compare favourably against similar managed funds.

Liquidity Risk

This exists when particular investments are difficult to purchase or sell within a timely period and at a fair price.

Interest Rate Risk

This refers to changes in the market values of fixed-interest securities. An increase in market interest rates typically results in a decline in the market value of fixed-interest securities. Similarly, a reduction in market interest rates usually increases the market value.

Derivative Risk

An investment manager may use financial derivatives, such as futures, options, swaps and forward rate agreements. Risks associated with derivatives include the value of the derivative not moving in line with the underlying use of fixed-interest securities. Asset, the counterparties to the derivative (including the option) are not able to meet payment obligations and the derivative position is difficult or costly to reverse.

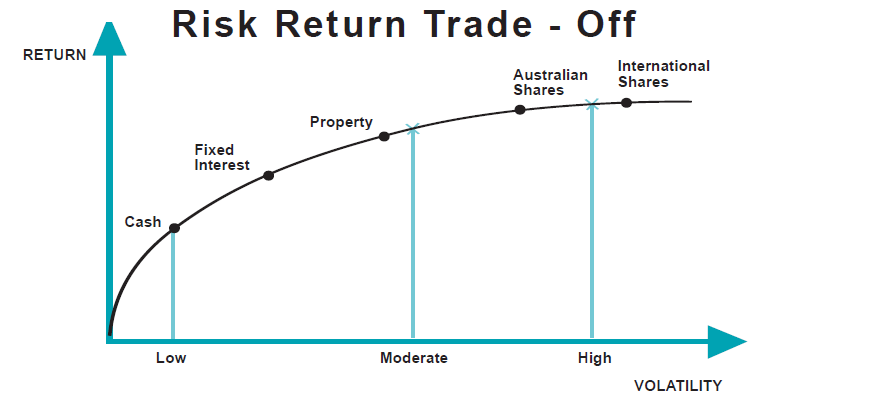

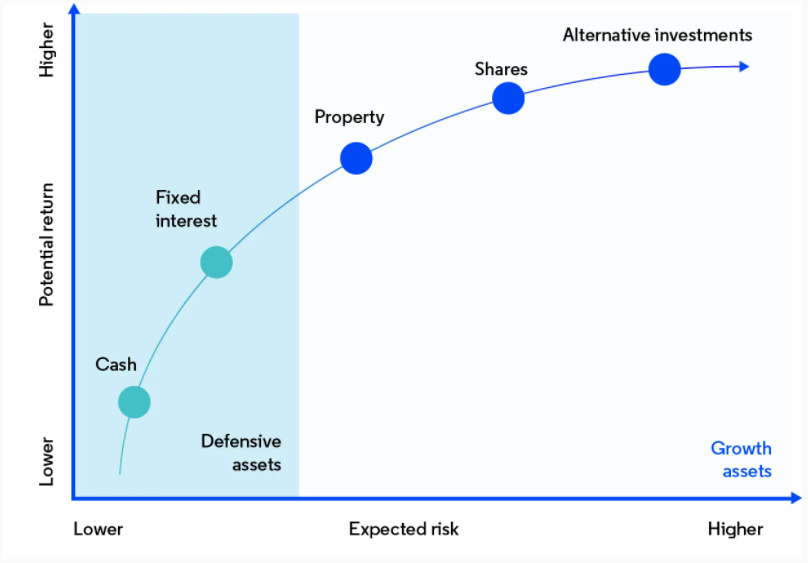

The relationship between Risk & Return

There is a direct link between risk and return. Investors must be prepared to accept additional risk to achieve higher returns. Shares and property may offer higher returns than other asset classes in the long term, but they will also provide the highest level of performance volatility. Generally, the higher the risk the investor bears, the greater the potential for short-term capital value fluctuations.

When determining the level of risk you are prepared to accept, it is important to factor in your investment time frame, i.e., how long you plan to invest. Another way to manage investment risk is to select investments that best match your goals and time frame. Some investors with short investment time frames are concerned about protecting their capital and have very different needs from investors who want their investments to increase significantly over a long period of time. The graph below illustrates the “risk/return trade-off” concept:

Source: AMP Financial Planning (illustrative only)

This second Graph shows the grouping of Growth Assets versus Defensive Assets and where this may appear on the Risk return curve.

Historically, each of the three major investment asset classes—stocks, bonds, and cash—has produced consistent long-term returns, along with consistent degrees of risk. Understanding these historical patterns can help you handle risk in your own portfolio.

Research completed by funds Manager Vanguard has shown that getting your asset mix right can have a greater impact on your long-term returns than anything else—it's even more important than the individual investments you choose.

How to strike a balance

For investors, risk comes in many forms. There is the risk of a downturn in stock prices, the risk that inflation will erode an asset's purchasing power, the risk of political instability affecting international markets, and so on.

Achieving long-term financial goals means accepting the trade-off between risk and reward and understanding the historical patterns that have gone along with the three primary asset classes. Historically, stocks have offered higher long-term returns than bonds or cash, but they have also carried more risk. Bonds have offered higher returns, with more risk, than cash. Cash has provided stability, but money stuffed in your mattress nets zero return and will probably fail to keep pace with inflation. Paradoxically, taking a conservative approach to market risk may expose you to a high degree of purchasing power risk.

Fundamentally, how you allocate your assets among stocks, bonds, and cash depends on how much risk you are willing to take for an expected return. And that depends on why you are investing and when you need your money. So, what is the right way to divvy up your portfolio? You will need to answer two basic questions:

1. What are your goals and time frame?

To manage risk effectively, first establish your goals. (Are you saving for retirement or a vacation? Or both?) Next, set a reasonable time period to reach them. Generally, the longer your time frame, the more money you can consider allocating to stocks and stock funds, which have the greatest long-term potential for growth.For near-term goals—those less than a year away—consider conservative cash investments, such as a money market fund. On the other hand, if you're saving for something a little farther out, such as a down payment on a house with a time frame of three years, give some thought to lower-risk assets like short-term bonds. If you're looking even further down the road to retirement, you may be able to afford to invest more aggressively in stocks, as long as you're willing to accept the added risk.

2. How well do you sleep at night?

* Illustrative purposes only. It is important to note that past performance does not indicate future performance.

Over the last 80 years, as you can see in the illustration above, stocks have turned in the strongest overall long-term performance of all three asset classes, with some painful short-term setbacks along the way. To be a successful investor, you need to expect the unexpected and be prepared for both good and bad days.

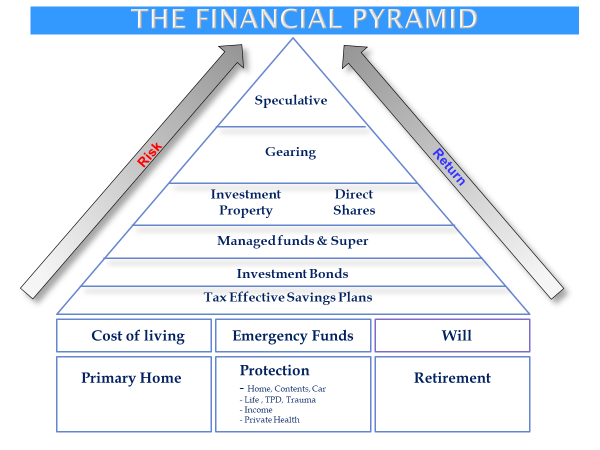

As the chart below shows, annual returns for stocks have fluctuated much more dramatically than for bonds and cash, ranging as high as +54% and as low as -43 %. It's easy to handle the upside of stocks, but some investors would have trouble sleeping after a steep drop. While bonds haven't offered the same high reward potential as stocks overall, they generally haven't fallen as far either. That's why having a mix of stocks and bonds in your portfolio can sometimes lessen the severity of turbulence.

This chart shows the minimum and maximum returns for a notional investment in Australian shares over the past 124.67 years (as at 30-Sep-2024), for 10 different holding periods - from 1 year to 10 years. For each holding period, we have calculated the average annual return achieved for each possible investment (using monthly returns). An example for the five-year holding period: Between Jan-1900 and Sep-2024, there were 1,438 possible 5-year investments (the first one from Jan-1900 to Jan-1905, and the last one from Sep-2019 to Sep-2024). Of those 1 438 periods, the highest average annual return was 40.39% pa, achieved over the period Aug 1982 - Aug 1987. The lowest average annual return was -9.15% pa, over the period Dec 1969 - Dec 1974. We use monthly returns of the ASX/S&P 200 Accumulation index (Source: Datastream) for the calculations from Jan-1900 to Sep-2024. Remember, indexes are not a representation of a financial product - they do not take account of costs or tax and do not reflect the performance of any individual portfolio of stocks. Past performance is not a reliable indicator of future performance. Investing in shares is subject to risk, and there is no guarantee that an individual investor will make a profit by investing in the share market.

So, how do we understand your appetite for investment risk?

We will provide you with a Risk Tolerance questionnaire that will assist us in determining your risk profile.

Your risk profile indicates how much risk you are willing to accept to achieve your desired return outcomes. Investing involves risk of one type or another. Some, like inflation risk, are well understood and can be quantified. Others, like the ‘event risk’ of an earthquake or major war, are less predictable.

Our experienced research team uses sophisticated modelling to identify and quantify the different types of risk, both at a market (economic) level and within the different asset classes. While it is impossible to eliminate all potential risks, a well-designed portfolio can smooth the variability of returns while increasing the chance that your investment strategy will meet your goals.

Once you have determined the risk profile, this allows us to design a strategy that is aligned to your needs and investment objectives, is aligned with your risk tolerance, and delivers the highest potential return for your level of comfort. We will then make sure that you understand how this is appropriate to your needs and circumstances. In this way, we produce an investment portfolio that is truly suitable for your goals and achieving the lifestyle you deserve.

Investment Concept 2: Types of Investments

Types of Investments: Asset Classes

Asset classes are the building blocks of any investment. The five main asset classes are cash, fixed interest, property, shares ad Alternative Assets.

Cash and fixed-interest asset classes are ‘defensive’ assets, which means they are designed to defend your investment from losses. These tend to be more popular for short-term or risk-averse investors – those who prefer safer, more secure investments with consistent returns.

Property and shares are ‘growth’ assets designed to grow your investment. These are higher-risk and more volatile assets. They are designed for long-term or aggressive style investors willing to ‘ride out the peaks and troughs of their investment due to their potential for higher investment returns. The most appropriate asset classes for your investment will depend on several factors, including your risk tolerance, how long you plan on investing, and your financial objectives.

Defensive Assets |

Bonds, Fixed Interest & Cash Defensive assets are low-risk investments that aim to protect the capital invested. They generally have lower returns over the longer term but lower risk in the short term. |

Type | Risk | Return | Timeframe | Description |

Cash | Low | Low 10 Yr Ave Return 3% | 0-3 Years | Cash is the generic term for highly liquid, short-term investments designed to be extremely safe. It carries the lowest level of return and may be affected by inflation. Cash assets include Interest-paying investments such as savings accounts and term deposits. The principal invested is guaranteed, and interest payments are calculated in line with official cash rates. |

Fixed Interest | Low to medium | Low to medium 10 Yr Ave return 3-4% | 0-3 Years | Fixed interest is more volatile than cash but is less volatile than growth assets. Fixed-interest investments include government and corporate bonds. The bond issuer is effectively a borrower and must pay interest to the investors throughout the bond's life and return the money borrowed upon the bond's maturity. Fixed interest carries a low to medium risk and predominantly rewards investors through a regular income stream, usually higher than earnings from a cash investment. Fixed interest covers Australian and international fixed interest and includes government, semi-government, and corporate bonds. Depending on the issuer, fixed interest offers a regular income with low to medium risk. Some fixed-interest investments may also provide capital growth. |

Growth Assets

Growth Assets |

Shares, Property, Alternative Investments Growth investments are at higher risk and offer a higher potential return compared to defensive investments. They aim to provide capital growth, and some also offer income (for example, dividends from shares or rental income from a property). They have the potential for higher returns over the long term but carry higher risk in the short term. |

Type | Risk | Return | Timeframe | Description |

Shares | High | Medium to High 10 YR Ave Return 6.5% p/a (Aust Shares) | At least 5 years | Shares or stocks are securities representing ownership in a company. The value of the shares will typically fluctuate with general economic and industry conditions and with fluctuations in company profitability. A company’s value can fall due to poor management, changes in consumer tastes, investor sentiment or several other unpredictable factors. Therefore, shares carry more risk of capital loss than cash or fixed interest. Well-managed companies can achieve high growth in value and earnings over time, which can be reinvested back into the business or distributed via dividends to investors. Where Australian companies pay tax on their profits, the dividends paid to investors carry franking credits, which provide tax benefits to the investors. Australian Shares include companies listed on the ASX. Australian shares offer longer-term capital growth and potential regular income through dividends. Australian shares may experience volatility over the short to medium term, with potential for capital growth and higher returns than defensive assets over the longer term. International Shares Include companies traded on international stock exchanges, including many household names not listed on the ASX. International shares offer increased diversification over investing only in Australian shares. However, investors risk increased volatility due to rises and falls in international share markets and currencies. Shares carry risks, including disappointing profits and dividends, management changes, or changes in the company's or industry's outlook. These changes may negatively impact dividend income or share prices. International shares are also influenced by global economic trends and individual country risks, such as politics and law. Changes in the value of currencies may also impact the value of international shares. |

Property | High | Medium to High 10 YR Ave Return 6.3% p/a (Aust Shares) | At least 5 years | Property covers listed and direct property, both within Australia and overseas and includes direct property and listed Real Estate Investment Trust (REIT) investments across residential and commercial sectors. REITs are pooled property investments that are broken into units and listed on stock exchanges to provide liquidity to investors. REITs generally invest in a range of residential and commercial properties, including retail shopping centres, office buildings, industrial factories, hotels and leisure centres. REIT prices fluctuate with underlying property fundamentals as well as with broader share market volatility. Direct property Investments - Includes residential, commercial and industrial properties. Direct property offers lower risk than shares and a regular income through rental returns with capital growth potential. Higher purchase prices for direct property investments may reduce portfolio diversification. Indirect Property Investments - Includes trusts investing in residential, commercial, and industrial properties. Listed property trusts (LPTs) offer greater diversification across a broader range of assets, including properties usually too expensive for individual investors to purchase directly, such as shopping centres, office towers and factories. LPTs can be traded on the ASX. Risks include vacancies, locational factors, unprofitable development, and declining values when properties are sold or revalued. |

Alternative assets

| Medium to High | Medium to High Returns differ depending on the investment. | At least 5 years | Alternative assets are investments that generally do not fit into the traditional asset categories outlined above. Risk can be controlled by limiting exposure to individual investments and seeking diversification of alternative asset opportunities. Examples of alternative assets include hybrids, exchange-traded funds (see TF, ass), listed investment companies (LIC, ass), private equity, leveraged leases, private property-related investments (e.g., infrastructure assets) and commodity hedge funds. |

Is your current asset allocation right?

As advisers, we regularly assess whether you are investing in the most appropriate asset classes for your current situation and taking the proper amount of risk to meet your financial goals. We check to make sure you are comfortable with the investments that you hold, even when markets go down. These are the questions that we, as your advisor, will help you answer.

Asset Class- Historical Returns

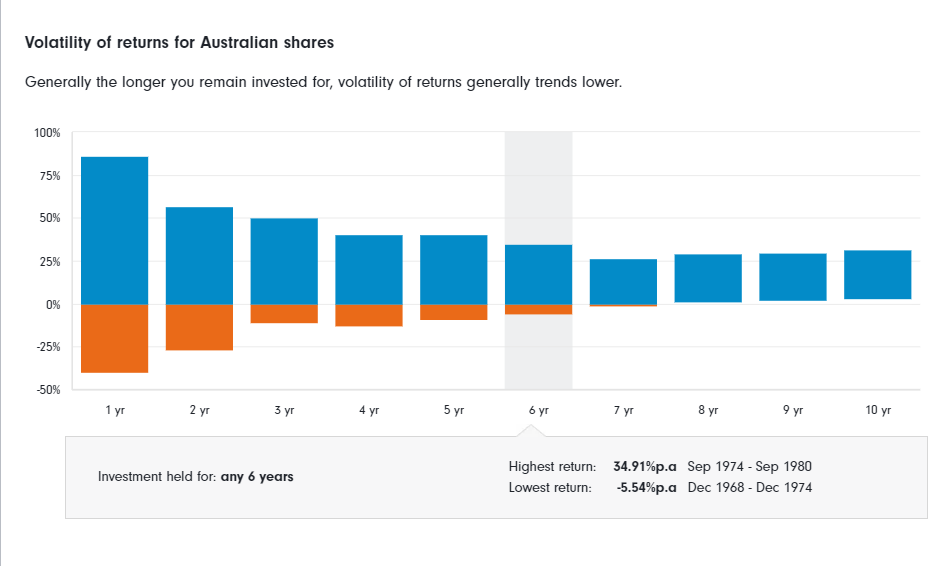

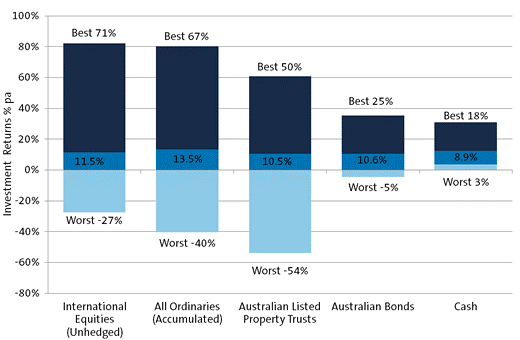

The following graph shows the range of Asset class returns over 30 years.

Source: AMP Capital Investors, Bloomberg, FactSet

The above graph illustrates how high-returning assets deliver the highest average returns, but they also have a much wider range between their peak and trough than bonds or cash, which reflects their relative volatility and the traditional relationship between risk and return.

It also shows how all defensive assets, such as Australian bonds, average rates of return just below international shares and comparable to Australian-listed property trusts. The global financial crisis of the late 2000s may have changed the old risk and return relationship for international investments and highlighted how strongly the Australian economy has grown relative to the world.

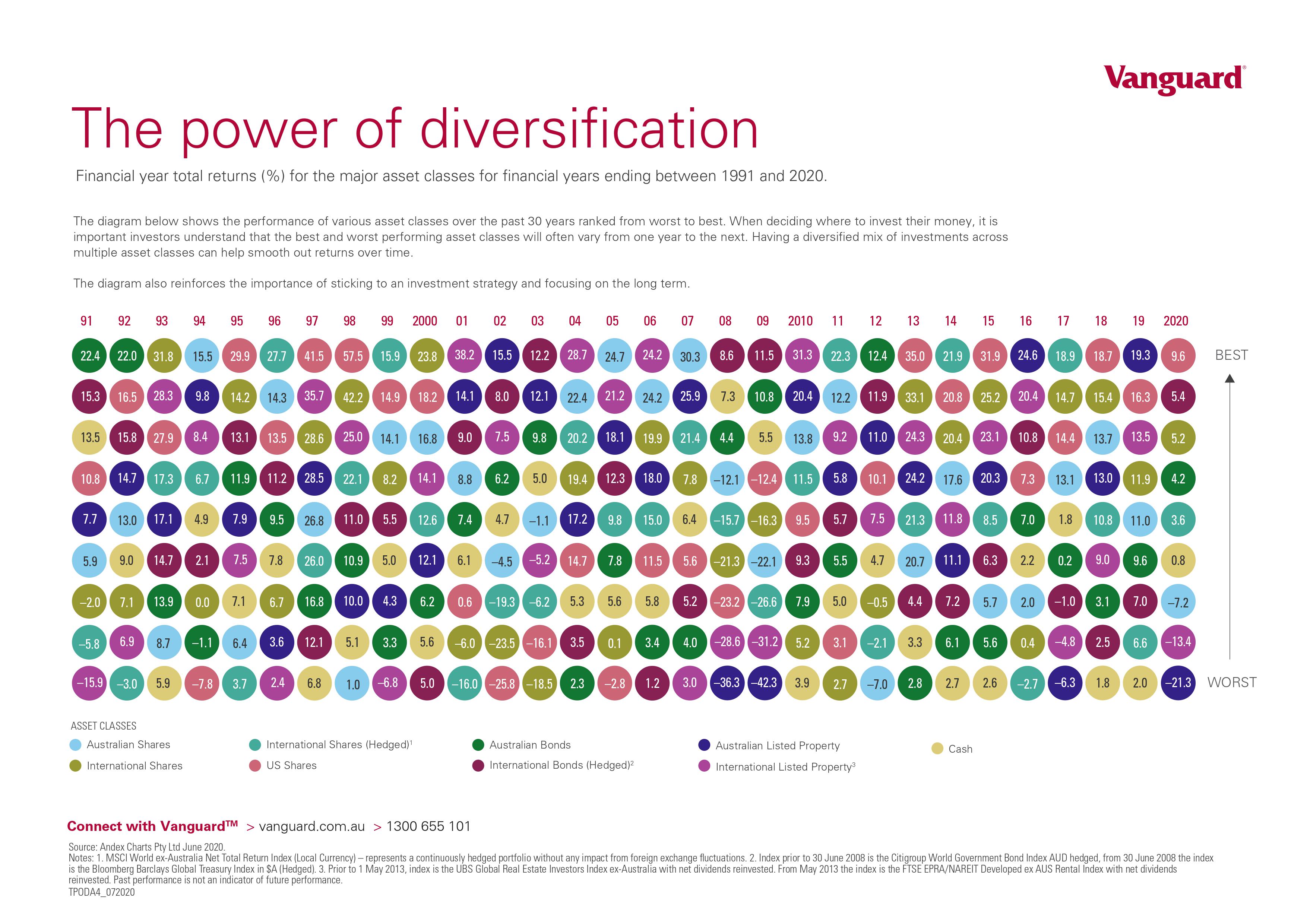

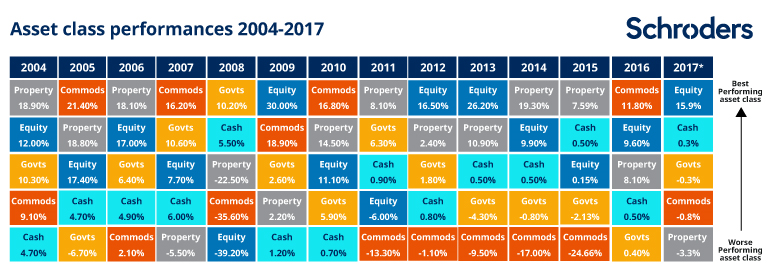

Investment Concept 3: Diversification

Diversification is a crucial method for mitigating the risks associated with investing. It involves spreading your money across different asset classes to provide more consistent returns. Sometimes, underperformance in one asset class can be offset by positive performance in another asset class. Depending on how you diversify, you can also potentially smooth out performance fluctuations by investing in multiple asset classes and funds managed by several fund managers.

Risk is limited by the fact that not all asset classes or industries or individual companies move up and down in value at the same time or at the same rate. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk.

This graph shows a range of returns from different assets over the years, showing that each year's different assets gave the best return. Ths demonstrates why a combination of asse5ts that are diversified provides the best possible outcome.

Managing Risk through Diversification

One of the most effective ways to reduce various types of risk is to diversify your portfolio. No one type of security, asset class or investment manager provides the best performance over all time periods. So, a range of investments should reduce the risk of each of the investments within a portfolio experiencing drops in performance at the same time. This is simply because one asset class or manager may perform well to counter the poor performance of another. Diversification can be implemented in three distinct ways:

Across Asset classes

History shows that spreading your money across various asset classes can be the best way to guard against short-term volatility in any one asset class and provide greater, longer-term returns. Whether it is short-term cash deposits, property investments or shares, you can diversify your investment based on your comfort level.

Market conditions change regularly, including interest rates, demand for property, share markets or even legislation and policy changes.

Each asset class may be the best performer at a different time of the market cycle. Diversifying across asset classes helps to reduce the risk of having a necessary exposure to one investment or one asset class, placing adverse conditions; it also means you’re able to benefit when one investment is performing well.

Across Markets & Regions

Spreading your exposure within each asset class across a wide range of countries, currencies, industries, and stocks ensures that your investment is not narrowly concentrated in a region or industry. This reduces the impact of a region or industry downturn. it is now relatively easy to invest in international markets from Australia. The performance markets around the world can differ greatly at any point in time. Considering international investment opportunities allows you to manage against the risk of the local market not performing. Did you know that the Australian stock market makes up just less than 3% of the world’s stock markets? It is also important to be aware that currency factors can also play a significant role in increasing or decreasing returns. Investing with respect to currency is often called hedging.

Across Fund Managers

Different investment management styles tend to excel under different economic and market conditions. By combining a range of investment managers with complementary investment styles, you may be able to neutralise the bias to any one style in each asset class.

In simple terms, diversification means ‘don’t put all your eggs in one basket. It means spreading your investments across different assets to balance your returns; if one asset class is performing poorly, another investment may be achieving better returns.

The benefits of diversification are illustrated in the graph below. If you invested in shares, as an example, the dotted line shows what your returns may have been over time. If you invested in fixed interest, your returns would have looked like the broken line. By investing 50% of your portfolio in shares and 50% in fixed interest, your return would have been straight down the middle of the returns of each of these asset classes and is illustrated with a straight line. These returns offset each other, and the combined return is, therefore, likely to be less volatile.

Which Asset classes are appropriate for your investment?

All investments carry some form of risk, and you need to be comfortable with the amount of risk you are willing to take. Your risk profile considers your attitude towards volatility, need for income, and time horizon for your investment. A qualified financial planner can help determine your risk profile by asking some simple questions:

- How much money do you need to reach your goal?

- What is the timeframe you have to meet your goal?

- Would you accept your investment falling behind the rate of inflation?

So what does it all mean?

Your attitude to investment risk is a crucial factor in determining an appropriate investment strategy to meet your needs. Investing is considered risky because there is uncertainty about how the investment will perform over the short and long term. Different types of investments experience different levels of volatility.

Negative returns can happen at any time, so during periods of poor performance, remaining invested for the minimum investment term will provide an opportunity for your portfolio to recover. Here are the main approaches to investing, otherwise known as investment risk profiles.

How will our advice help you diversify effectively?

Diversification spreads your investment portfolio across different asset classes to reduce volatility and deliver ‘smoother’ returns over time. Effective diversification means selecting a mix of investments that addresses your specific investment needs.

We will design your portfolio to meet your needs, ensuring that it is fully diversified across and within all asset classes. We will diversify your investment to take advantage of the fact that different asset classes can move independently.

For example, the share market index can rise while the bond market is stable, or vice versa. The key is to have a portfolio with a combination of assets and strategy that will meet your investment needs with the least amount of risk. This is our expertise and understanding of how to ensure you take advantage of the above.

So, what is your Asset Allocation?

Asset allocation is the name given to the mix of asset classes you choose to build your portfolio. The common asset classes are cash, fixed interest, property, shares and alternatives. Your asset allocation is one of the most important factors in determining the returns and risks in your portfolio. Selecting a suitable mix will play a crucial role in ensuring your portfolio achieves your objectives within your comfort zone. Your asset allocation is the 1st step towards developing your personalised investment portfolio. The five Asset Allocation options we use are listed at the back of this booklet.

The Asset Allocation Process

Step 1: Define your Goals and Time Horizon

The first step in the asset allocation process is to define your goals and the corresponding time horizon. Typical investment goals include:

- Funding your retirement

- Funding the educational needs of children and grandchildren

- Funding goals like a vacation home or a wedding

- Funding your retirement

- When creating an inheritance or other legacy fund, generally accepted time horizons are:

- 1 to 2 years - Immediate

- 3 to 5 years - Short Term

- 5 to 10 years - Long Term

Step 2: Assessing Your Risk Tolerance.

Assessing your risk tolerance (Risk Profile) generally involves completing a risk tolerance questionnaire. Many factors are examined when assessing your risk tolerance. These may include:

- Your investment time Horizon ( how long will you need the money for)

- Financial Resources ( how much can you set aside to achieve this goal)

- Financial Priorities ( which goals take precedence)

- Previous investment experience or knowledge

- Your liabilities or Obligations ( what can get in the way of achieving this goal)

- The Investor's Personality ( behaviours and attitudes)

Step 3: Identify Target Asset Allocation Model for Implementation

Often, the net result of a risk tolerance questionnaire is a recommended risk profile to guide your investment allocation.

This recommended allocation may be represented as a model portfolio. Here are some examples of suggested model portfolios that are based on an investor's risk tolerance:

- Preservation (100% Defensive & Income Only)

- Defensive (70% Income and 30% Growth)

- Balanced (50% Growth, 50% Income)

- Balanced Growth (70% Growth, 30% income)

- Growth (85% Growth / 15% income)

- High Growth (100% Growth)

Step 4: Review and Rebalance Regularly

No one should expect their investments to run on autopilot and monitor themselves. That is why the most important step in the asset allocation process may be to ensure that you continue to monitor your allocation. Different assets perform differently over time. This may necessitate regular portfolio rebalancing. Additionally, changes in your life, like marriage, divorce, a new child, severe illness or injury, or external events or issues ( wars, etc) may change your tolerance for risk and, therefore, change your asset allocation.

Your Risk profile is just a starting point. Once you have determined the risk profile, we will select investments to match a portfolio that is aligned with your needs and objectives and then explain how this is appropriate to your needs and circumstances. This will also be recorded in an advice document, generally known as a Statement of Advice.

Investment Concept 4: Investment Types

Managed & Direct Investments

What are Managed Investments?

A managed Investment fund pools an individual’s money with that of other investors to invest and is managed by specialist investment managers on the client’s behalf.

Managed funds come in many shapes and sizes. Some funds invest in just one type of investment, such as Australian shares, while others, known as diversified funds, invest across a range of asset classes, including Australian shares, international shares, fixed income, property securities and cash.

So, whether the amount being invested is $2,000 or $200,000, the money has access to the investment buying power of millions of dollars. This buying power means you can benefit from opportunities normally only available to large corporations or those with extensive specialist knowledge.

How are Managed Investment Funds Structured?

Most managed funds are structured as unit trusts. When you invest, your money buys ‘units’ in a fund. The number of units you receive depends on the amount you invest and the current unit price. If a unit in a fund was worth $1 and you invested $2,000, you would receive 2,000 units (less the value of an entry fee and transaction costs, if applicable).

The unit price reflects the value of the fund’s investments. If the value of the investments rises, the unit price rises. Likewise, if the value of the investments falls, so does the unit price.

The pooled money is then invested and controlled by a professional investment manager in different asset classes that align with their investment objectives. Examples of these asset classes include shares, fixed interest, cash securities or property.

Managed investment schemes cover a wide variety of investments, including:

- Cash management trusts

- Property trusts

- Australian equity (share) trusts

- Agricultural schemes (e.g. horticulture, aquaculture, commercial horse breeding)

- International equity trusts

- Some film schemes.

- Timeshare schemes

- Some mortgage schemes.

- Actively managed strata title schemes.

There are literally thousands of Managed Investment schemes in the market.

Managed Funds v’s Direct Investments

Direct investments are where you invest in and own the investment directly. They include residential and commercial property, direct shares held through a broker or via an online platform, or other riskier investments such as gold, precious coins, art, or vehicles.

The table below outlines some of the differences between Direct and Managed investments.

Managed Funds vs. Direct Investments | |

MANAGED Funds | DIRECT Investments |

Professional Investment Management - Teams of specialist investment managers constantly analyse the investments of the funds and make decisions on when to buy and sell securities | You are the Manager - When investing directly, someone will need to actively manage the investment selection and the portfolio on an ongoing basis, organising trades and researching investments. |

Economy of scale - All trading is done at the fund level, with economies of scale achieved regarding the brokerage cost. | Increased Costs - Each individual investor will pay brokerage on each buy and sell transaction |

Greater Diversification - Diversification through a managed fund can be easily achieved with a range of investment options available; this allows clients to spread their investments across various manager styles and asset classes, allowing the client to reduce risk and improve returns. | Lack of Diversification & Access to International Markets - It may be difficult for an individual investor to fund a well-diversified portfolio, and certain investments may be closed to individual investors or may be difficult or expensive for an individual investor to access. Examples include alternative investments, infrastructure, international bonds and international shares. |

Size & Scale - Further, the size and scale of managed funds allow access to investments that may not be available to individual investors | Smaller investment amounts, lack of scale |

Efficient & Convenient - Managed funds offer individuals a convenient and efficient method of investing. When investing in a managed fund, the fund manager will handle all the paperwork and administration, provide regular information on the fund’s performance, and provide annual tax statements and tax guides. | Administration & Management - An investor will need to keep track of the performance, income and tax obligations involved with each investment that they hold. |

What types of Managed Funds are available?

There are five asset classes you can invest in: cash, fixed interest, property, Australian shares and international shares. Each has its own level of risk as well as a potential return.

Managed funds can be used to invest in any one (or a combination) of these assets. The types of managed funds include:

Types of Managed Funds | |

Fund type | Description |

Capital protected | Investments that include a capital guarantee of the initial investment amount, usually up to a set percentage (often 100%) |

Education savings plans | Investment products are designed to be used to save for the future education expenses of children. |

Ethical funds | Integrate personal values with investment decisions while keeping track of individual investment goals. |

Geared funds | Rather than borrowing to invest, the fund borrows on your behalf, which means you don't have to increase your personal borrowing. |

Hedge funds | Managed funds invest in a broad range of assets while profiting from both rising and falling markets. |

Index funds | Fund investing in all or part of a market to replicate the performance of the relevant index |

Exchange-traded funds (ETF) | An ETS is a managed fund that you can buy or sell on an exchange, like an Australian securities index (ASX); in Australia, most ETFs are passive investments that do not try to outperform the market. The role of the fund manager is to track the value of an index, for example, the ASX 200 or the S&P 500. Or a specific commodity such as gold, copper, etc. The value of each goes up or down with the index or asset tracking. |

Investment bonds | Tax-paid investments on a long-term basis, with a minimum holding of 10 years. |

Managed accounts | Accounts linked to a broad range of managed funds while joining the flexibility of owing direct equities. |

Property trusts | Access investments in listed and unlisted properties that are trust-owned directly or by a securitised offering. |

Sustainable investment funds | An investment approach designed to maximise investment returns by analysing sustainable investment opportunities. |

Model Portfolios | A combination of funds meeting your risk profile and investing in different asset types, class sectors, countries and industries. |

What makes managed funds so attractive?

1. You can start small.

To invest in a managed fund, you need a smaller amount of money (as little as $1,000) to gain exposure to the various sectors of the market and dozens of individual stocks.

One of the keys to investing successfully is investing on a regular basis. Setting aside as little as $100 a month can add up to a substantial sum when you invest it regularly for longer periods. You can choose small monthly or weekly amounts and transfer your payments on the day you get paid.

2. It is an easy way to diversify your investments.

The beauty of managed funds is that you can access different asset classes, companies, industries, sectors and countries with a relatively small amount of money. Investing directly requires large sums of money to gain this range of exposure.

3. It is a cost-effective way to invest.

Investing directly into shares or property comes at a cost. Expenses such as brokerage, stamp duty and agents’ fees can significantly affect the value of your investment. Costs for managed funds have come down considerably over the last few years, and they are very cost-effective.

Managed funds allow you to access certain investments at a fraction of the usual cost. This is because you share these costs with other members of the fund rather than having to pay the minimum investment fee on your own.

4. Your money is managed by Experts.

Your investment will be managed by professionals with the education, focus, and skill to make appropriate investment decisions. These experts have access to investment research and information not easily available to individual investors.

5. You don’t need to sell an entire house to access your money.

You can generally access your money within five to ten days after making a request. However, accessing capital in direct investments, particularly property, can be very difficult, costly, and time-consuming.

Managed funds have a major advantage over direct property investments in that you don’t have to sell the whole investment to access some capital. Or incur large transaction costs such as stamp duty.

Investment Concept 5: Simple vs. Compound Interest

Some people say that compound interest is the 8th wonder of the world! We agree so much that we use the power of compound in many of the strategies we employ.

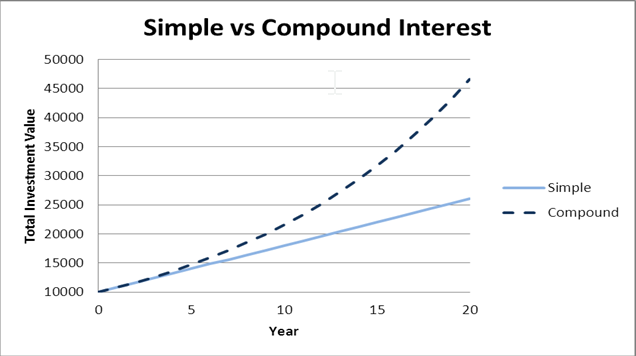

The graph below illustrates the difference in the value of an asset earning interest over 20 years on an initial investment of $10,000, assuming an annual return of 8% after fees. Simple interest is interest paid on the original $10,000 and paid out to the investor every year.

With compound interest, interest is earned on the original $10,000, but interest is reinvested every year and earns more interest, growing the principal, earning more interest on that.

So, interest is earned on the original amount and the reinvested interest as well!

Investment Concept 6 – Dollar Cost Averaging

Dollar-cost averaging is a common strategy that advisers use to achieve the best outcome over time when investing your money. The way this concept works is like this:

This is where we invest regular amounts at regular times, regardless of the market value and movements, rather than try to pick the right time to invest or invest one lump sum. Over time, this strategy should average the value of your investment by smoothing out the differences in value over time. Here is an illustration of how dollar cost averaging works:

Ben’s Story…

Note: This example does not consider any distributions paid during this period. This is a general illustration of possible strategies only and is not an estimate of the investment returns you will receive or the costs you will incur. You should seek advice from a financial planner on your own personal circumstances before making an investment decision.

How this works

The above example illustrates how dollar-cost averaging has improved Ben’s investment position. He has managed to secure a lower average unit price ($7.07 instead of $8), and if he redeems his units now, he will make a strong return.

It is worth noting that dollar-cost averaging also helps maintain a disciplined approach to investing: when prices decline and many pull out of the market, you will continue to invest the same amount and acquire more units at a lower unit price. And when prices are high, and many rush back into the market, you will buy fewer units. It eliminates market ‘emotion’ from investment decisions and reduces the impacts of market peaks and troughs.

Investment Concept 7 – Investment Cycles

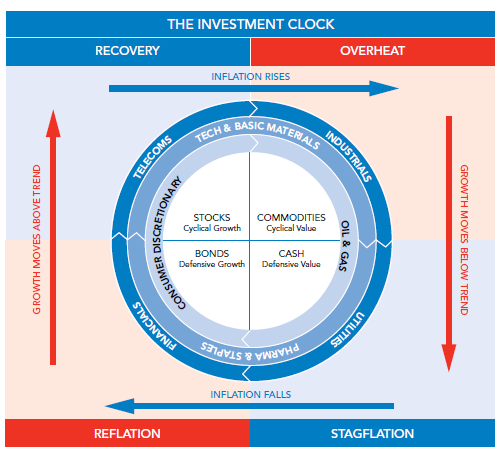

In volatile times, a simple model can help investors understand where we are in the economic cycle and what might come next. Fidelity International uses an ‘Investment Clock’ that links the performance of asset classes and equity sectors to the global economic cycle. Using the clock, we can estimate what phase we are in.

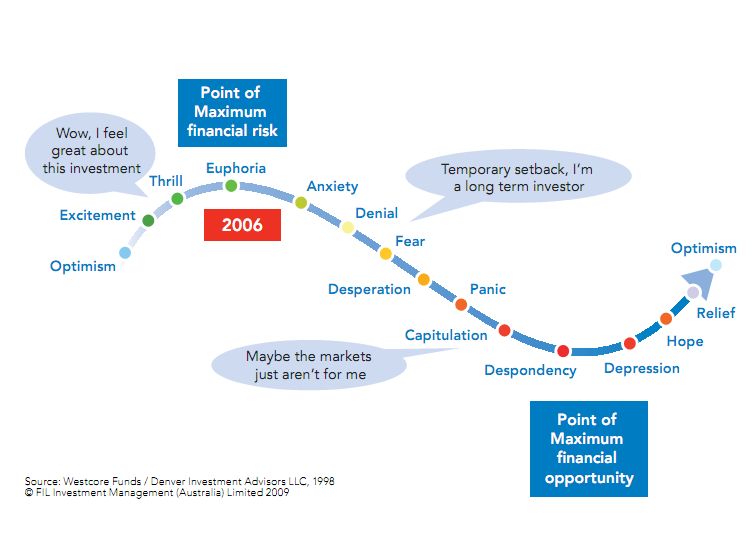

The Equity Sentiment Roadmap

So, how do we, as your adviser, help you invest?

Having a plan to secure your financial future can be a life-changing event. But investing requires you to make big decisions today about a largely uncertain future. Markets are challenging because they are inherently unpredictable. Some recent twists and turns include Pandemics, Global financial crises, record-low interest rates, record rates of interest rate rises, high inflation, International wars and conflicts, intermittent volatility (market swings), and intervention by governments on a scale never seen before.

As an Adviser, our role is to help you plan for your future; we provide robust portfolio solutions to deliver outcomes based on our understanding of your needs. We build these investment portfolios to match your appetite for investment risk in order to deliver the best outcome for your specific needs.

Our portfolio solutions also incorporate market insights from our experienced research teams, coupled with high-quality investment managers. The portfolios we provide have an investment strategy anchored by quality strategic advice principles, including:

- Full understanding of your financial needs.

- Efficient risk management.

- Truly effective diversification.

- Rigorous investment selection process and

- Regular monitoring and reporting.

Notwithstanding the above, we also have an obligation to educate you and ensure you fully understand the process we are engaged in with you. We believe that by the end of this process, you should know as much as we do about managing investments and understand the process we undertake for you.

Asset Allocation Terminology

Asset Allocation

Asset allocation is the process of determining how to spread an investment between categories of financial assets. Asset allocation is generally driven by the desire to optimise the risk-return trade-off according to an investor’s time horizon and risk tolerance. Asset allocation does not assure a profit and does not protect against loss in a declining market.

Risk Tolerance

Risk tolerance is the level of risk you are willing to take to achieve an investment goal. The higher your risk tolerance, the more risk you are willing to take on. Higher-risk investments often have the potential for greater reward but also a higher potential for greater loss. Risk tolerance may be assessed through the scoring of a risk tolerance questionnaire.

Time Horizon

Time horizon refers to the period of time a sum of money is expected to be invested. Your investment time horizon depends on when and how much money will be needed. In general, the shorter the investment time horizon, the less risk an investor should be willing to accept. Time horizons are often stated as short-term (1-3 years), medium-term (3-5 years), and long-term (10+ years).

Portfolio Rebalancing

Portfolio rebalancing is the process of making adjustments to counteract the fact that different assets perform differently over time. These adjustments are made to correct the asset allocation drift that results from performance differences in your asset selections. You should consider rebalancing your portfolio at least once a year.

Correlation

Correlation is the technical term for comparing how different assets perform relative to each other during varying market cycles. Analysts measure this on a scale ranging from 1.0 (meaning the two assets move precisely in tandem with each other) to -1.0 (meaning they move in opposite directions).

For more definitions and financial information, click here